Global Trade Shift-Deep Dive into Nearshoring Impact

July 2025

Global supply chains have faced a series of continuous and compounding disruptions, beginning with the outbreak of COVID-19 in 2019 and the subsequent global lockdowns. These shocks were further exacerbated by the ongoing Russia–Ukraine war, escalating geopolitical tensions in the Middle East—which have disrupted navigation through critical maritime routes like the Suez Canal—and the intensifying trade war between the United States and China.

Collectively, these events have exposed the vulnerabilities of the globalization-driven offshoring model, prompting international businesses to reconsider their outsourcing strategies. As a result, many companies have begun shifting towards nearshoring—relocating operations closer to home to reduce risk, improve responsiveness, and shorten supply chains. Alongside this, a parallel approach known as friend-shoring has gained traction, where firms prioritize moving operations to politically allied countries to mitigate geopolitical risks.

This blog explores the global shift from traditional offshoring to more secure and strategic outsourcing models such as nearshoring and friend-shoring, and how this will change the global trade directions. It also highlights Egypt’s unique position and growing potential as a nearshoring hub for international companies across various sectors—an opportunity that aligns strongly with the country’s efforts to promote investment for export and deepen its integration into global value chains.

Shifting the Global Trends: From Offshoring to Alternatives

Globalization did not begin with China’s accession to the World Trade Organization (WTO) in 2001, but that milestone significantly accelerated its pace. By granting the world access to a vast labor market of over one billion low-cost workers, China’s integration into the global economy gave unprecedented momentum to the rise of offshoring—a practice where companies relocate various operations, from manufacturing to customer service, to other countries in pursuit of efficiency and cost savings.

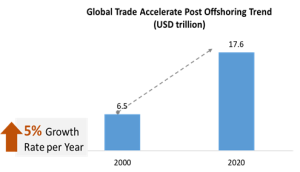

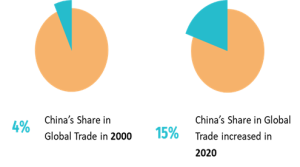

As offshoring gained traction, cross-border trade quickly became the norm for multinational companies. This shift contributed to a dramatic expansion in global trade, with its total value increasing from $6.5 trillion in 2000 to $17.6 trillion by 2020. During the past two decades, China’s share of global trade surged from under 4% to nearly 15%, underscoring the country’s pivotal role in shaping modern supply chains and the globalization landscape[i].

Figure 1: The Impact Offshoring on Global Trade Trends

|

|

This rapid adoption of offshoring was driven by a range of compelling benefits that made it an attractive strategy for global businesses. Chief among these was the significant reduction in production costs, allowing companies to enhance profitability by leveraging lower wages and operational expenses in developing markets. Offshoring also offered access to a vast and diverse talent pool, enabling firms to scale operations quickly and tap into specialized skills that were often scarce or more expensive at home. Additionally, many host countries provided streamlined regulatory frameworks and investor-friendly policies, making it easier for foreign companies to establish and operate their businesses with minimal bureaucratic hurdles. These advantages collectively fueled the global shift toward offshore operations and deeply embedded offshoring into the DNA of international trade.

Figure 2: Motives for Companies to Adopt Offshoring Strategies

|

The period 1980–2010 was dominated by Offshoring. However, there has been a marked slowdown in offshoring activities between 2007-2009 due to the 2008 Global Financial Crisis. Correspondingly, Nearshoring started, as an alternative, to emerge mainly from the European and American markets.

Yet, Nearshoring was not that much spread, as studies showed that only around 2% of German manufacturers were actively engaged in reshoring and nearshoring activities between 2010 to mid-2012, and from 2014-2018, only 253 cases of reshoring and nearshoring were counted in Europe, where the estimated number of jobs created because of these relocations is 12,840[ii].

Since late 2019, the global economy was shocked with a series of unfortunate events, that reshaped the global scene of supply chains; the spread of COVID-19 pandemic and the repercussions of the global lockdown, passing by the Russian Ukrainian War, the regional tensions in the Middle East, and concluding by the US-China Trade War. All these events were followed by seemingly endless shortages and supply chain disruptions putting extra inflationary pressure on the whole system.

Big corporations were not the only part that suffered from supply chains disruptions, average consumer and producers all over the globe also had to cope with the chaos, which led many companies around the world, especially in the US and Europe, to start searching frantically for solutions to provide security against such disruptions. Hence, nearshoring among other strategies such as reshoring and friend-shoring started to emerge immensely.

Figure 3: New Outsourcing Strategies

|

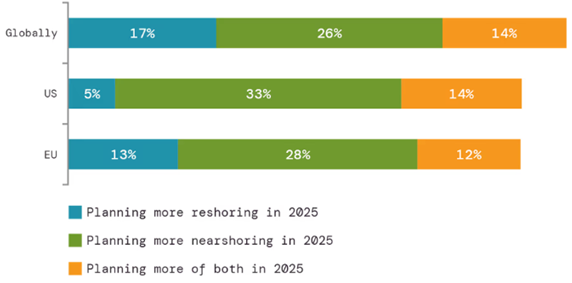

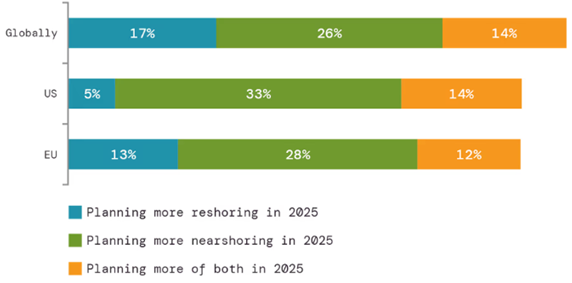

In the recent business survey conducted by QIMA[iii], the results indicated that 26% of companies surveyed globally were planning to nearshore their businesses in 2025. The percentage increase in the EU to reach 28%, and even more in the US with 33% planning to nearshore their businesses in 2025. The plans towards nearshoring significantly exceeded those towards reshoring as the percentage ranged between 5% and 17%.

Figure 4: Nearshoring & Reshoring Plans Reported by QIMA 2025 Sourcing Survey

|

Source: QIMA

Nearshoring: Cons & Pros

Nearshoring provides a set of advantages including:

- Closer geographical proximity: travel and communications are easier as the buyer is likely to be at a similar time zone. In addition to shortening supply chains (faster transport to the target customer), that entails huge cost saving.

- Cost savings: Other than shipping cost, Nearshoring can be more cost effective depending on the location and the type of job.

- Larger talent pool: A business can significantly expand access to various high-quality service providers and outsourcing partners.

- Reducing the risk of delays.

- Lower customs duties, as most regional preferential trade agreements are with countries in close proximity.

On the other hand, there are some downsides to nearshoring, including:

- Language barriers: While not true in all instances, there are some cases where language barriers and cultural differences can make maintaining a coherent working relationship difficult, which affects the quality and smoothness of production process.

- While nearshore outsourcing provides a larger talent pool than onshore outsourcing, it’s not as large of a talent pool as offshore outsourcing.

- Less convenience. In some cases, it’s not as convenient for teams in different locations to work together, leaving their comfort zone.

Shifting Trade Trends in the World of Nearshoring

Based on the analysis of trade and economic data for more than 150 countries, as well as the expected impact of recent national and regional policy initiatives, BCG identified several tectonic shifts in global trade corridors by 2033, driven by the ongoing nearshoring and friendshoring trends. The trends are summarized as follows[iv]:

- North America is solidifying into a more resilient and integrated trade bloc, driven by deepening US-Mexico-Canada ties and long-term friendshoring efforts aimed at reducing reliance on Asia—especially China. BCG projected that US-Mexico trade will grow by USD 315 billion (4%), while US-Canada trade will expand by USD 147 billion (1.9%). However, major changes to US tariffs on Mexican and Canadian imports can change the magnitude and the direction of trade flows.

- Friendshoring is reshaping North American trade dynamics. Assuming relatively stable relations, annual U.S. trade with the EU is projected to rise by $303 billion—equivalent to a 3.1% CAGR—by 2033. Efforts to reduce tariffs and align trade policies in key sectors such as automotive and advanced manufacturing will further strengthen transatlantic ties. However, a resurgence of protectionism—such as the tariffs introduced during the Trump administration—could slow or even reverse this momentum.

- The Trump tariffs are estimated to potentially reduce EU GDP by somewhere between 3% to 1.5% depending on how large, how broad, and how retaliations/unilateral actions play out[v] [vi]. Such drag would weaken the EU economy, reduce its capacity and appetite for investment, and increase the cost of US-EU trade. For friendshoring, this means that while there is an incentive to build stronger, more secure supply chains across the Atlantic, the cost of doing so becomes higher under aggressive tariffs.

- China is expanding its economic presence in Africa, continuing to diversify its global trade partnerships through nearshoring. China’s trade is expected to grow by USD 173 billion by 2033.

- EU-China trade is expected to stagnate, prompting the EU to strengthen ties with traditional allied partners (e.g., the US and Japan), in addition to nearshoring in emerging markets (e.g., Turkey, and African countries)

- North Africa is projected to become a key nearshoring destination, especially for manufacturing supply chains from the EU and China.

Figure 5: How Trade Flows between Nations and Regions Will change by 2033

|

Source: BCG

Nearshoring in Global Textile Industry: A Case Study

The global textile and apparel industry has long been recognized as a “migrating industry “one that historically relocates to regions offering lower labor costs, favorable trade policies, and scalable infrastructure. Over the decades, production has shifted from Europe and North America to East Asia, and later to South Asia and Southeast Asia. Today, however, the rising nearshoring trend is becoming a mainstream approach across the textile value chain.

Following the disruptions in global supply chains, retailers and brands are rethinking their sourcing strategies in favor of shorter lead times, reduced risk exposure, and improved supply chain agility. In the textile industry, which is deeply tied to fast fashion and seasonality, speed to market has become a critical competitive advantage.

A 2023 McKinsey & Company survey revealed that over 70% of North American apparel executives plan to increase nearshoring or reshoring in the next five years, with Central America, Mexico, and parts of Eastern Europe cited as top destinations due to their proximity, skilled labor, and trade advantages[vii].

Moreover, the WTO and World Bank have emphasized the increasing role of regional value chains in textile manufacturing, noting that proximity sourcing reduces not only cost and time but also carbon emissions—an increasingly important factor as consumers and regulators demand more sustainable practices.

A prime example of this global trend is the U.S. textile and apparel industry’s pivot toward Central America. Historically reliant on Chinese imports, the U.S. is now increasingly sourcing from nearby countries such as Honduras, El Salvador, Guatemala, and the Dominican Republic. This shift is largely influenced by supply chain bottlenecks, rising production costs in Asia, and the strategic benefits of geographic proximity.

Under the Dominican Republic–Central America Free Trade Agreement (CAFTA-DR), U.S. companies benefit from duty-free access to textile and apparel products produced using U.S. yarns and fabrics, creating a mutually reinforcing trade relationship. According to the National Council of Textile Organizations (NCTO), bilateral textile and apparel trade between the U.S. and CAFTA-DR countries reached USD 15.1 billion in 2022, supporting over 1 million jobs across the region. (NCTO, 2023)[viii].

In addition to commercial benefits, nearshoring has broader socio-economic implications. It helps reduce migration pressures by creating local job opportunities, fostering industrial development, and contributing to poverty reduction in the region.

Egypt: The Next Nearshoring Hub

As BCG predicts, the center of gravity of world trade is poised for a turn to the south. As Southeast and South Asia, as well as Sub-Saharan Africa, MENA, and Latin America will all be central to trade growth in future.

Among all these changes and the global direction towards developing regions including MENA region, Egypt is proven to becoming an increasingly popular destination and a prime candidate for nearshore companies to outsource their business services mainly due to the following key attractions.

|

With access to international waters and control over the Suez Canal—one of the world’s most critical maritime corridors—Egypt is well-positioned to facilitate global trade flows. The country is connected by 155,000 km of paved roads, 10,500 km of railway that enhances logistics efficiency[ix].

Egypt has 18 commercial ports and 27 airports, ensuring seamless inland and international cargo movement. Notably, Egypt’s transit time to Europe is remarkably short—just 6 to 12 days—compared to 24 to 35 days from many Asian countries. Reflecting this advantage, Egypt ranked first in Africa in terms of connectivity index in Q4 2024, underlining its growing prominence as a gateway between continents[x].

The country offers relatively low labor costs compared to other emerging markets such as China, Turkey, Brazil, and South Africa, with an average monthly wage rate of just USD 140. In addition to cost efficiency, Egypt boasts a large and growing working-age population of over 29 million individuals. This workforce includes semi-skilled, skilled, and highly qualified labor, providing a robust talent pool for diverse industrial and service sectors. This combination of affordability and availability enhances Egypt’s appeal as a nearshoring hub.

Egypt has extensive global trade integration through more than 29 Free Trade Agreements (FTAs), granting access to over 3.1 billion consumers worldwide. These agreements cover key regional and international markets, significantly enhancing Egypt’s export potential. Notable FTAs include partnerships with major economic blocs and countries such as COMESA, GAFTA/PAFTA, Egypt-MERCOSUR, Egypt-Turkey, Egypt-EFTA, the European Union, and the UK. These agreements reduce or eliminate trade barriers, enabling Egyptian products to enter global markets more competitively and supporting the country’s position as a vital trade hub.

To fully leverage these strengths and seize the nearshoring opportunity, Egypt should consider the following:

- Develop Sector-Specific Nearshoring Clusters: Egypt should identify and prioritize key sectors—such as textiles and apparel, agribusiness, pharmaceuticals, and electronics—for the development of specialized industrial clusters. These zones should be equipped with targeted infrastructure, streamlined regulatory frameworks, and customized incentives to attract foreign investors seeking nearshoring solutions.

- Accelerate Regulatory Reforms and Facilitate Investment: Simplifying customs procedures, enhancing transparency, and fast-tracking industrial licensing will be essential to improve the ease of doing business. Establishing a “Nearshoring Facilitation Unit” under the General Authority for Investment and Free Zones (GAFI) could offer tailored support to companies relocating operations to Egypt.

- Strengthen Multimodal Logistics and Trade Infrastructure: While Egypt has a competitive logistics backbone, continuous investment in ports, dry ports, and rail connectivity—especially linking Upper Egypt to Red Sea and Mediterranean hubs—will be critical to support efficient supply chains and cross-border movement.

- Leverage FTAs to Attract Export-Oriented Investments (Invest for Export): Egypt should launch an international promotional campaign that highlights its preferential trade access to key markets. By showcasing successful use cases of companies benefiting from FTAs, Egypt can build credibility and attract businesses seeking duty-free access to Africa, Europe, and the Arab Region.

By implementing these actions, Egypt can not only ride the wave of global nearshoring but also elevate its role in global value chains, create quality jobs, and accelerate industrial upgrading—advancing its ambition to become a leading regional hub for investment and export.

[i] https://www.savills.com/impacts/market-trends/can-nearshoring-solve-supply-chain-resilience.html

[ii] Reshoring: Myth or Reality? | OECD Science, Technology and Industry Policy Papers | OECD iLibrary (oecd-ilibrary.org)

[iii] https://www.qima.com/newsroom/news/news-q2-2025-barometer?_gl=1*1s0hstk*_ga*MTU4NDE4NTQwNy4xNzUyMTMyODYy*_ga_RWLJ5W9747*czE3NTIxMzI4NjEkbzEkZzAkdDE3NTIxMzMwNTckajYwJGwwJGgxNTA4NjMyNzk.*_gcl_au*MTk5NjEzODM5Ny4xNzUyMTMzMDU3

[iv] Great Powers, Geopolitics, and Global Trade | BCG

[v] Why Trump’s plans for tariffs could be bad for Europe’s economy | Euronews

[vi] The economic impact of Trump’s tariffs on Europe: an initial assessment

[vii] https://www.mckinsey.com/industries/retail/our-insights/is-apparel-manufacturing-coming-home

[viii] https://www.thecentralamericangroup.com/investment-in-central-america/

[ix] CAPMAS

[x] World Bank

No comment